Excitement About Unicorn Financial Services

Wiki Article

The Basic Principles Of Refinance Broker Melbourne

Table of ContentsIndicators on Mortgage Broker Melbourne You Should KnowThe Only Guide for Melbourne Mortgage BrokersMortgage Brokers Melbourne Can Be Fun For EveryoneFacts About Mortgage Brokers Melbourne UncoveredLoan Broker Melbourne for Beginners

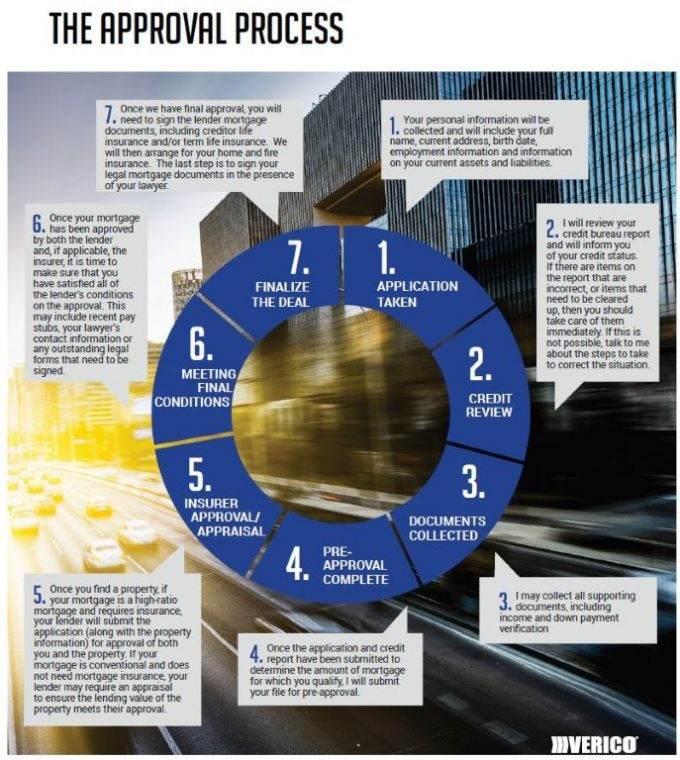

An expert mortgage broker originates, bargains, as well as processes property as well as commercial home loan in behalf of the client. Below is a six point overview to the services you should be supplied and the assumptions you need to have of a professional mortgage broker: A home loan broker supplies a vast array of home loan from a variety of different loan providers.A mortgage broker represents your rate of interests instead than the passions of a lending institution. They should act not just as your agent, but as a knowledgeable professional and also trouble solver. With accessibility to a wide variety of mortgage products, a broker has the ability to provide you the best value in regards to rate of interest, repayment quantities, and also funding products (mortgage broker melbourne).

Numerous circumstances require more than the simple usage of a 30 year, 15 year, or flexible rate home mortgage (ARM), so innovative home loan approaches and also sophisticated remedies are the advantage of collaborating with a skilled home loan broker (https://nextgenbusinesscitations.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). A home loan broker navigates the client via any situation, taking care of the process and smoothing any kind of bumps in the road in the process.

Borrowers that locate they need bigger car loans than their financial institution will certainly accept likewise benefit from a broker's understanding as well as ability to effectively acquire financing. With a home mortgage broker, you only require one application, as opposed to completing types for each private lender. Your home mortgage broker can give an official comparison of any kind of financings advised, directing you to the info that accurately represents price differences, with existing rates, factors, and closing prices for each loan mirrored.

Broker Melbourne Fundamentals Explained

A respectable home mortgage broker will certainly divulge exactly how they are spent for their solutions, in addition to information the overall prices for the loan. Customized solution is the separating factor when selecting a home loan broker. You must anticipate your mortgage broker to aid smooth the method, be offered to you, as well as recommend you throughout the closing procedure.:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Functioning with a mortgage broker can possibly conserve you time, initiative, and also money. A home loan broker may have far better and extra accessibility to lending institutions than you have.

Top Guidelines Of Refinance Melbourne

A mortgage broker executes as liaison for a monetary establishment that offers finances that are safeguarded with property and also individuals who wish to purchase property and also need a finance to do so. The home mortgage broker functions with both consumer and loan provider to obtain the borrower accepted for the finance.A home loan broker usually functions with numerous different lenders as well as can supply a range of funding choices to the debtor. A borrower does not have to work with a home mortgage broker.

While a home mortgage broker isn't needed to promote the transaction, some loan providers might only function with home mortgage brokers. If the lender you like is amongst those, you'll require to use a home loan broker.

They're the individual that you'll deal with if you approach a lender for a funding. The financing police officer can assist a customer comprehend as well as select from the car loans supplied by the loan provider. They'll address all concerns, help a debtor get pre-qualified for a financing, and aid with the application process.

Mortgage Broker Melbourne for Beginners

Mortgage brokers do not supply the funds for lendings or approve finance applications. They help individuals seeking house finances to find a lender that can money their residence acquisition. Beginning by making certain you understand what a home loan broker does. Ask close friends, relatives, as well as organization colleagues for references. Have a look at on-line testimonials and examine for problems.Ask concerning their experience, the precise aid that they'll give, the charges they bill, as well as how they're paid (by loan provider or debtor). Additionally ask whether they can assist you in specific, provided your particular monetary scenarios.

Encountered with the predicament of whether or not to utilize a home mortgage broker or a lender from a bank? When you are looking to buy a home, nevertheless, there are 4 vital aspects that home loan brokers can offer you that the loan providers at the bank just can't.

Individual touch seems to be increasingly much less typical in today's society, but it should not be. None of us live the same life as another, so modification is necessary! Acquiring a house is kind of a big deal! At Eagle Home mortgage Firm, personal touch is something we pride ourselves in. You reach deal with one of our representatives directly, that has years of experience and also can respond to any type of inquiries you could have.

All About Broker Melbourne

Their hrs of operation are normally while you're currently at work. Obtain the personal touch you are worthy of with a home loan broker that cares! The versatility image source a home loan broker can use you is just an additional reason to prevent going to the bank.

Report this wiki page